In the world of insurance, ensuring that your premiums are paid on time is crucial. Insurance providers, including State Farm, require timely premium payments to maintain your coverage. However, life can sometimes throw unexpected challenges, making it difficult to meet financial obligations. In this article, we’ll explore the topic of State Farm cancellation notices due to nonpayment of premiums.

Understanding the Importance of Premium Payments

Insurance policies are a safety net, protecting you and your assets in times of need. To keep this safety net intact, premium payments are essential. These payments fund your coverage, ensuring that it’s there when you need it most.

The Grace Period: A Safety Net of Its Own

State Farm, like many insurance providers, typically offers a grace period for premium payments. The grace period is a specified duration after your due date during which you can make your payment without your coverage lapsing.

When Missed Payments Lead to a Cancellation Notice

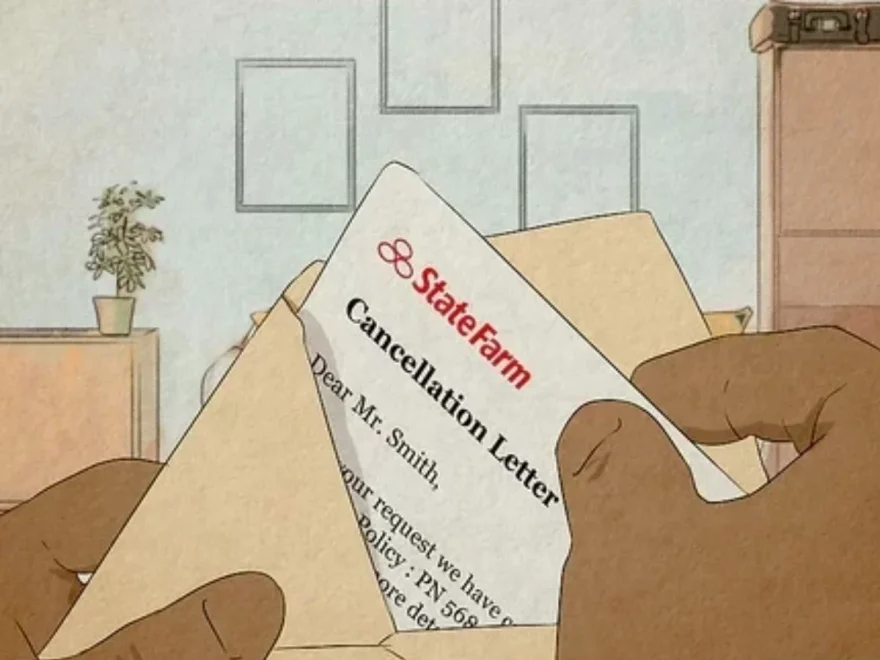

So, what happens if you miss your premium payment and exceed the grace period? This is where State Farm may send you a cancellation notice. This notice serves as a legal requirement before terminating your policy. Its purpose is to inform you that your coverage is in jeopardy due to nonpayment.

What to Do If You Receive a Cancellation Notice

If you find yourself in the situation of receiving a State Farm cancellation notice for nonpayment, here’s what you should do:

1. Review the Notice Carefully

Start by carefully reviewing the contents of the notice. Ensure that it indeed pertains to nonpayment of premiums and not due to any other reasons.

2. Contact State Farm Immediately

If you believe the cancellation notice is in error or if you’re facing financial difficulties that prevented you from making the payment, don’t hesitate to contact State Farm immediately. They understand that life can be unpredictable, and they may provide guidance on potential solutions.

3. Make the Required Payment

If your policy is indeed at risk due to nonpayment, take action promptly by making the necessary premium payment as soon as possible. State Farm may reinstate your coverage once they receive the payment.

Preventing Future Cancellation Notices

Of course, the best course of action is to prevent future cancellation notices. Here’s how you can avoid finding yourself in this situation:

Enroll in Auto-Pay

Consider enrolling in State Farm’s auto-pay program. This ensures that your premiums are automatically deducted from your account on the due date, reducing the risk of missed payments.

Set Up Payment Reminders

Set up reminders or alerts to notify you of upcoming premium due dates. This simple step can help you stay on top of your payments.

Budget Wisely

Include insurance premiums in your monthly budget to ensure that you allocate funds for timely payments. Prioritizing your insurance payments can help you maintain your coverage without disruptions.

Conclusion

Receiving a State Farm cancellation notice due to nonpayment of premiums can be a concerning experience. However, it’s essential to understand why you received the notice and what steps you can take to address the issue. By staying proactive and responsible with your premium payments, you can ensure that your coverage remains intact when you need it the most.

Frequently Asked Questions (FAQs)

- Can I reinstate my State Farm policy after receiving a cancellation notice for nonpayment?

Yes, you can often reinstate your policy by making the required premium payment. Contact State Farm for specific details and instructions. - Is there a specific grace period for premium payments with State Farm?

The grace period may vary depending on your policy and state regulations. Refer to your policy documents or contact State Farm for precise information. - What happens if I ignore a cancellation notice from State Farm?

Ignoring a cancellation notice can result in the termination of your policy, leaving you without coverage. It’s crucial to take prompt action. - Can I negotiate a payment plan with State Farm if I’m facing financial difficulties?

State Farm may be willing to work with you to establish a payment plan if you’re experiencing financial challenges. Contact them as soon as possible to discuss your options. - Are there additional fees associated with reinstating a canceled State Farm policy?

The fees and requirements for reinstating a canceled policy may vary. Contact State Farm for specific information regarding any associated costs.

Read More: https://kohlscom-activate.com/

More Related:

Allstate Insurance Agent Salary in Canada: What You Need to Know

How Does Walmart Allstate Protection Plan Work?

Does Allstate Have a Grace Period for Auto Insurance?

if I buy a car on the weekend will my insurance cover its state farm?

Does Allstate Have a Grace Period for Homeowners Insurance?

How to Cancel Allstate Insurance on the App: A Step-by-Step Guide

How to Cancel State Farm Renters Insurance Online: A Comprehensive Guide