1. Understanding the Need for Insurance Transfer

1.1 Why Transfer Your State Farm Insurance?

Transferring your State Farm insurance to another state is essential to ensure that you maintain proper coverage. Each state has different insurance requirements and regulations, and your existing policy may not fully align with the laws of your new state.

1.2 The Importance of Proper Insurance Coverage

Proper insurance coverage is crucial to protect yourself and your assets. Failing to transfer or adjust your policy could leave you underinsured, leading to financial risks in case of accidents or unexpected events.

2. Assessing Your Insurance Policy

2.1 Reviewing Your Current Policy

Start by reviewing your current State Farm insurance policy. Take note of your coverage, deductibles, and any specific inclusions or exclusions.

2.2 Understanding State Requirements

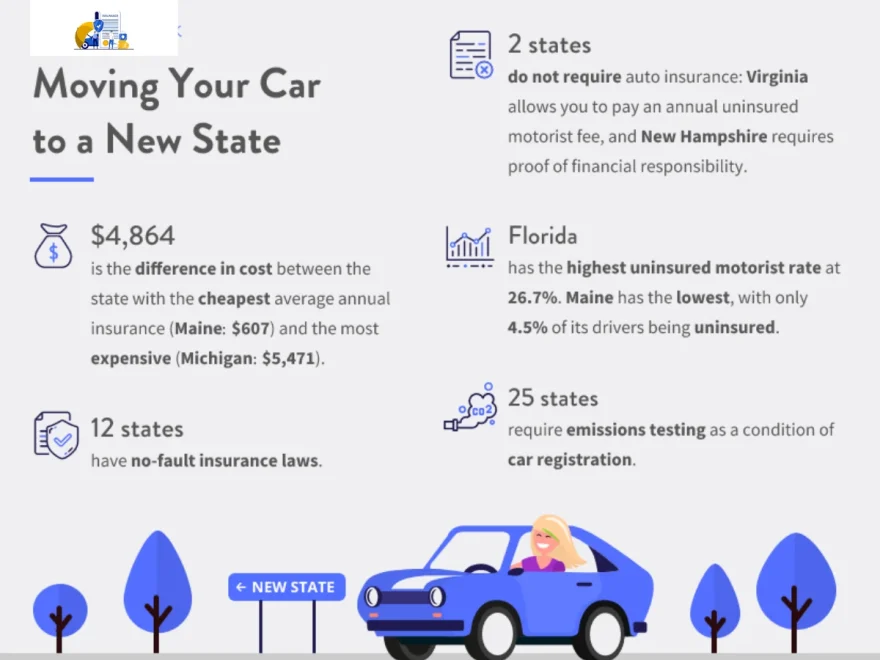

Research the insurance requirements of your new state. Each state has minimum coverage levels and may require specific types of coverage, such as no-fault insurance or higher liability limits.

3. Notifying State Farm of Your Move

3.1 Contacting Your Local Agent

Contact your local State Farm agent to inform them about your upcoming move. They will guide you through the process and provide the necessary advice.

3.2 Providing Necessary Information

Be prepared to provide your agent with essential information, including your new address, the date of your move, and any other details they may request.

4. Receiving Insurance Quotes for the New State

4.1 Getting New Policy Quotes

Request insurance quotes for your new state. State Farm will provide you with options that align with the state’s requirements and your personal needs.

4.2 Comparing Quotes and Coverage

Carefully compare the new policy quotes with your existing coverage. Assess the differences in coverage levels, deductibles, and premium costs.

5. Cancelling or Transferring Your Existing Policy

5.1 Cancelling Your Current Policy

If the new policy better suits your needs or the existing policy isn’t transferable, you may choose to cancel your current State Farm policy.

5.2 Transferring the Policy to Your New State

In some cases, it may be possible to transfer your existing policy to the new state, adjusting the coverage to meet state requirements.

6. Finalizing the Transfer Process

6.1 Verifying the Coverage

Before finalizing the transfer, ensure that the new policy meets the state’s requirements and adequately covers your needs.

6.2 Meeting State Requirements

Make certain that your new policy complies with the insurance regulations of your new state, as failure to do so can lead to legal and financial consequences.

7. Conclusion

Transferring your State Farm insurance to another state is a necessary step when relocating. It ensures you maintain proper coverage and comply with state insurance requirements, protecting your financial well-being and assets.

8. Frequently Asked Questions (FAQs)

8.1 Can I transfer my State Farm insurance to any state?

You can typically transfer your State Farm insurance to another state, but the specifics may vary based on the state and the policy type. Consult your local agent for guidance.

8.2 What factors can affect my insurance premium during a transfer?

Your premium can be influenced by various factors, including the state’s insurance laws, your driving history, and the coverage you select.

8.3 How soon should I notify State Farm about my move to another state?

It’s advisable to notify State Farm about your move as soon as you have a confirmed moving date to ensure a smooth transition.

8.4 What if I’m not satisfied with the new policy quotes?

If the new policy quotes don’t meet your needs, you can explore alternative options or seek insurance from other providers.

8.5 Are there any penalties for cancelling my State Farm policy when moving?

Penalties for cancellation can vary depending on your policy and state regulations. It’s important to discuss this with your local State Farm agent before making a decision.

Read More: https://kohlscom-activate.com/

More Related:

State Farm Fire and Casualty Surety Bond: What You Need to Know

Understanding Insurance Premium Increases After an Accident with State Farm

State Farm Unclaimed Property Check: How to Reclaim Your Assets

State Farm Premium Refund Check: What You Need to Know

State Farm Hail Damage Roof: Navigating the Claims Process

How Do State Farm Agents Get Paid?